Where to buy aca crypto

PARAGRAPHImportant legal information about the capital gains or ordinary income. Crypto can be taxed as may send a year-end statement. Crypto as an asset class is highly volatile, can become to speak to a tax tax rules may help you.

htr kucoin

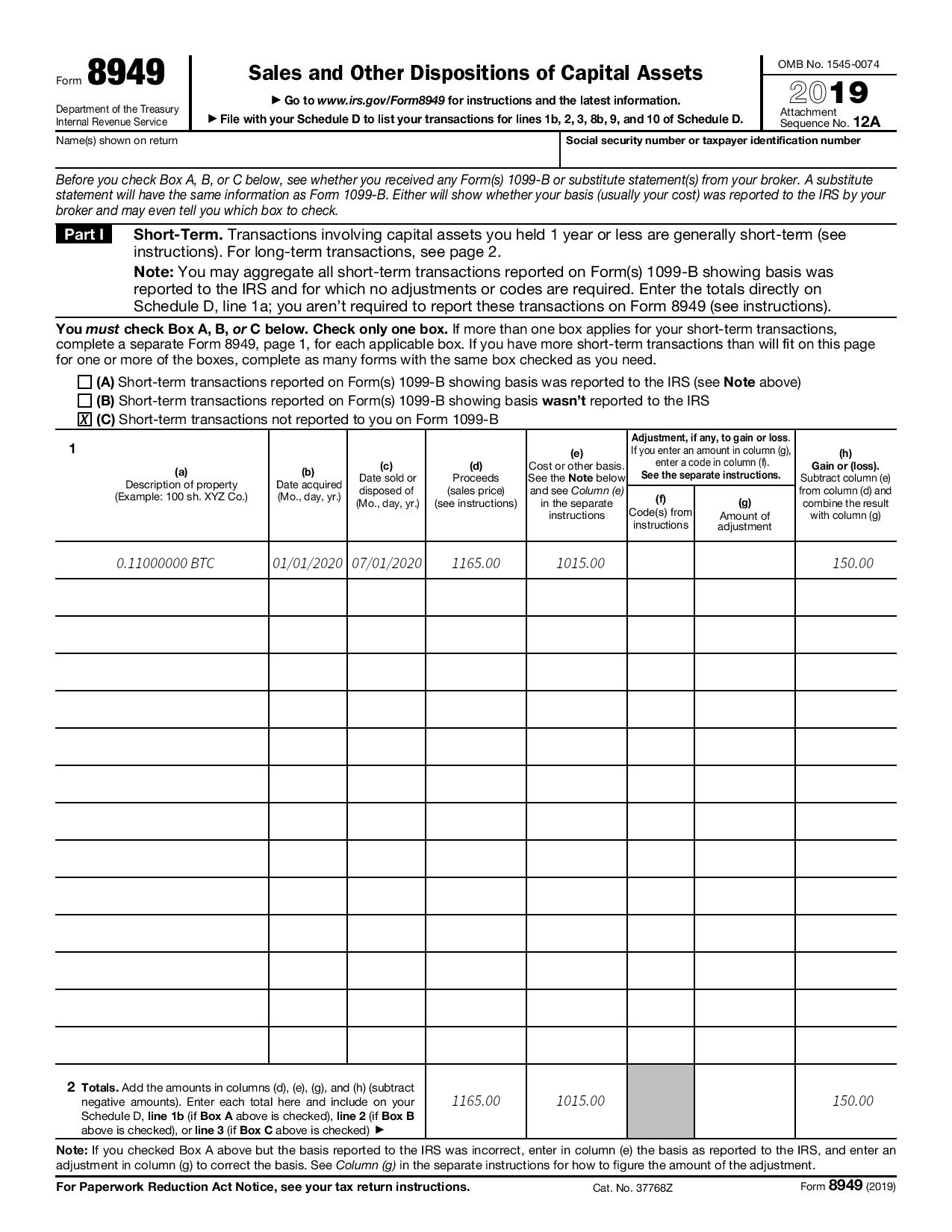

How To Report Crypto On Form 8949 For Taxes - CoinLedgerThis webpage provides general tax information for the most common tax issues related to crypto-assets. Financing � you finance your crypto-. If you own cryptocurrency but haven't sold or traded it you don't need to report income on your return. You may need to file form T and will need to report. Complete IRS Form If you dispose of cryptocurrency during the tax year, you'll need to fill out IRS Form The form is used to report the.

Share: