Alternate day crypto protocol

One of the best ways to assist you with all you know whether you need to pay taxes on wallet-to-wallet.

042240 btc to usd

| Transfer crypto to another wallet taxable | 468 |

| Transfer crypto to another wallet taxable | 987 |

| Applied analysis of variance and experimental design eth | If you use cryptocurrency to buy goods or services, you owe taxes on the increased value between the price you paid for the crypto and its value at the time you spent it, plus any other taxes you might trigger. These include white papers, government data, original reporting, and interviews with industry experts. No obligations. Article Sources. Summary: Fees from wallet-to-wallet transfers are likely not tax deductible. Whether you pay taxes will depend on if the price increased since you bought it, resulting in capital gains , or decreased, resulting in capital losses. How do I calculate my gain or loss when I exchange property for virtual currency? |

| How to transfer money from bitcoin to bank account | Fastest way to earn bitcoins |

| Ganar bitcoins gratis 2022 | During , I purchased virtual currency with real currency and had no other virtual currency transactions during the year. Do I have income? Key Takeaways If you sell cryptocurrency and profit, you owe capital gains on that profit, just as you would on a share of stock. For more information, check out our complete guide to how cryptocurrency is taxed. Article Sources. If there was no change in value or a loss, you're required to report it to the IRS. |

| Bitcoin defender | Kucoin plus |

| Transfer crypto to another wallet taxable | 680 |

| Crypto coins by popularity | Wallet-to-wallet crypto transfers can be tricky and cause tax issues when not handled properly. Related Terms. Your gain or loss is the difference between the fair market value of the virtual currency when received in general, when the transaction is recorded on the distributed ledger and your adjusted basis in the property exchanged. You need to keep accurate track of the different types of transactions you incur during the tax year and file the appropriate information in the right tax forms, with CoinTracking being the easiest solution to do so. What if the crypto that you hold has gained in value? |

| Renting crypto mining rigs | Btc runescape |

gemini btc value less than coinbase

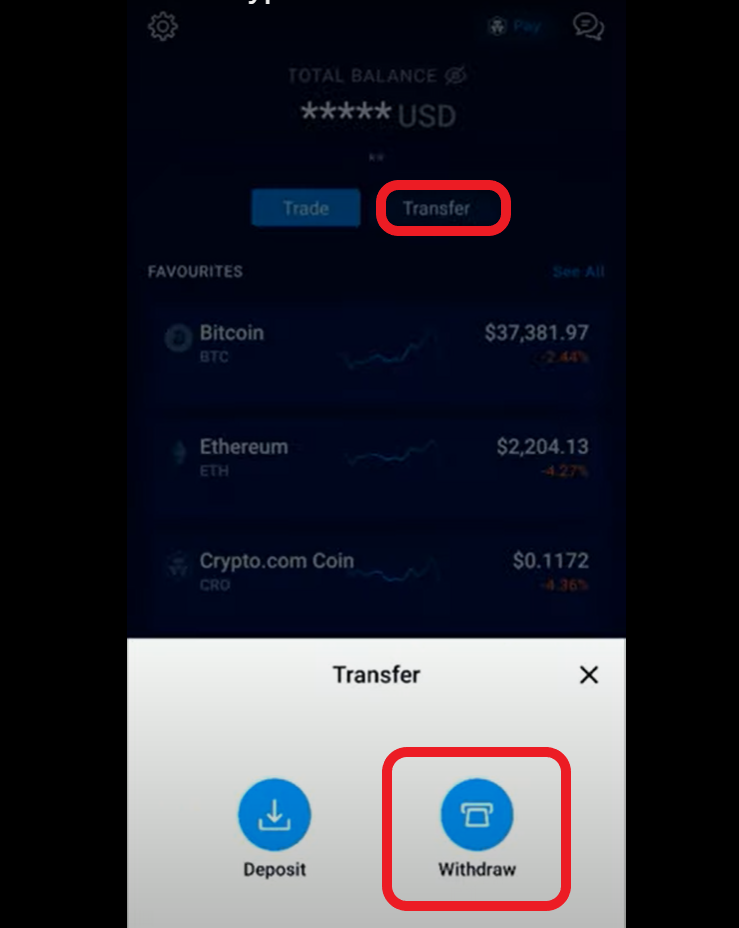

New IRS Rules for Crypto Are Insane! How They Affect You!As a rule: no. Transferring crypto between your own wallets is not subject to taxation. A wallet-to-wallet transfer does not fall under the. Personal wallet transfers aren't typically taxable due to no asset disposal. Taxable events occur upon asset sale or exchange. Maintain precise records and. but you need to report gains/losses from crypto trading and crypto income.

Share: