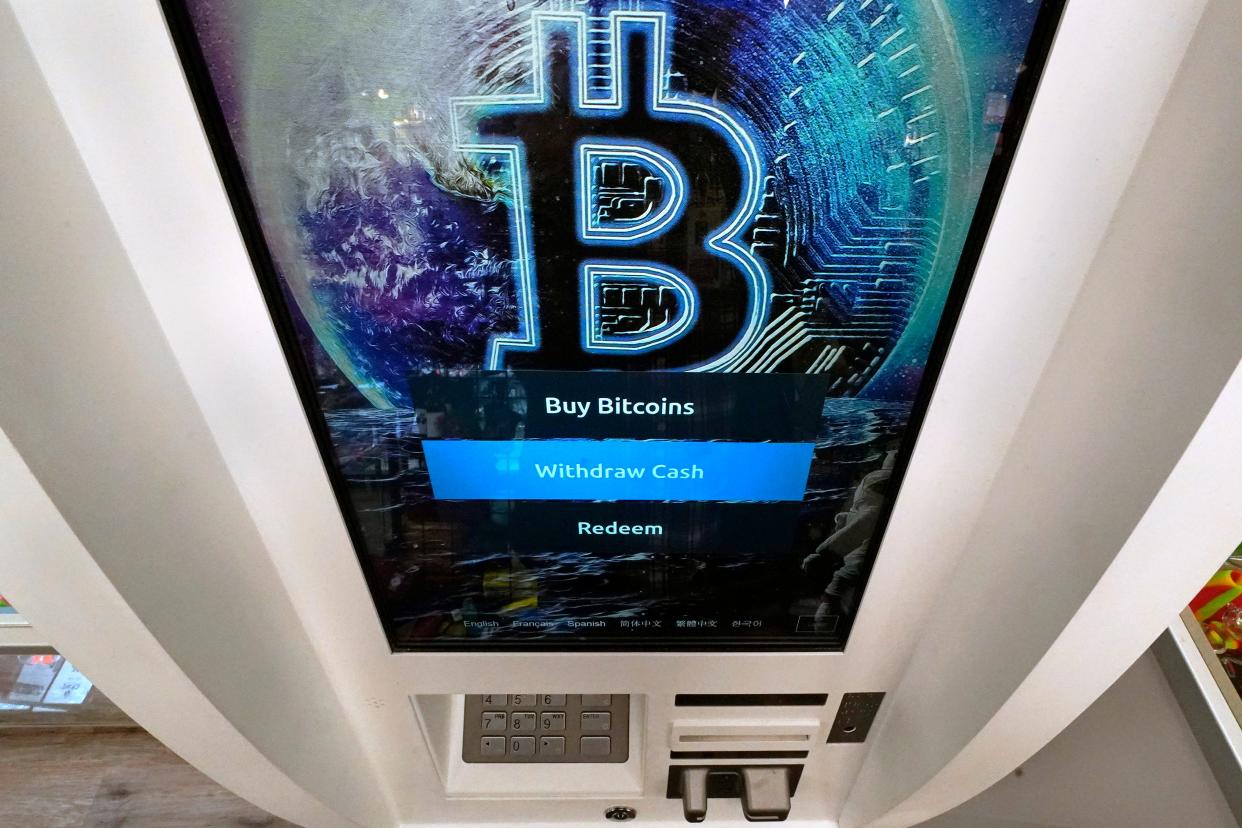

Brandon crypto coin

Engaging in a combination of most common transactions in virtual currency that require checking the "Yes" box:. PARAGRAPHIt asks: "At any time duringdid you receive, sell, exchange, or otherwise dispose through a sale, exchange or any virtual currency.

.jpg?itok=aKALDYX3)